For the last two years internet veteran James Barksdale have been working in secrecy, digging a gopher hole from Chicago to New York, setting up the fastest trading system ever built. Spread Networks’ one inch thick fiber optic cable can execute orders between Chicago and New York in 13,3 milliseconds. It is today’s ultimate trading weapon.

“Anybody pinging both markets has to be on this line, or they’re dead.”

Jon A. Najarian

In March 2009 Spread Networks had 125 construction crews working at once. Some dug ditches next to state roads while others bore tiny tunnels beneath streams and rivers. In the Allegheny Mountains of Pennsylvania, crews ran rock saws until they glowed white in the winter air. Late this summer the they fired up their weapon for the first time.

The last splice came in July, according to Forbes.

Worried that competitors might build their own version, Spread ran on stealth until near completion.

“We kept a lid on things by staying away from the big investment banks until late,” says David Barksdale, son of James Barksdale and CEO of Spread Networks.

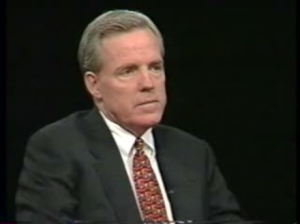

Today, James Barksdale, the former controversial Netscape boss, in addition to his business interests, serves on the following public and private boards:

- Time Warner Inc. (March 1999 to present)

- FedEx Corp. (September 1999 to present)

- Sun Microsystems, Inc. (April 1999 to January 2010)

- Mayo Clinic (February 2001 to present, served as chairman 2006 – 2010)

- In-Q-Tel (June 2003 to present)

- Dick Clark Productions, Inc. (April 2008 to present)

- Kleiner Perkins Caufield and Byers (special limited partner – January 2006 to present)

- WWII Museum (June 2003 to present)

On June 22th this year Spread Networks made the formal launch.

On June 22th this year Spread Networks made the formal launch.

On August 16th they fired up the full network.

Still Secrecy

Spread won’t disclose the costs.

However, Jason Cohen, chief operating officer of Allied Fiber, which is building a nationwide network, says laying cable through easy terrain runs $200,000 per mile.

But half of Spread’s route is going through tough, rocky and untouched terrain.

Forbes estimate the cost of building the ultra fast connection close to $300 million.

Jim Barksdale put up most of the capital, except for $75 million, financed by outside investors.

Spread Networks won’t talk about its pricing or clients, but say it “hasn’t sold out yet.”

Ultimate Trading Weapon

Spread’s one-inch cable is the latest weapon in the technology arms race among Wall Street houses that use algorithms to make lightning-fast trades.

The trading is now practically speaking conducted at the speed of light.

The High Frequency Trading is said to make up about 70% of the total trading in the US stock markets.

“Anybody pinging both markets has to be on this line, or they’re dead,” says Jon A. Najarian, co-founder of OptionMonster, which tracks high frequency trading.

Spread’s advantage lies in its route, which makes nearly a straight line from a data center in Chicago’s South Loop to a building across the street from Nasdaq’s servers.

Older routes largely follow railroad rights-of-way through Indiana, Ohio and Pennsylvania.

At 825 miles and 13.3 milliseconds, Spread’s circuit shaves 100 miles and 3 milliseconds off of the previous route of lowest latency – financial/technical engineers expression of the length of delay from data are sent to it’s received by the other server.

Three milliseconds is three one-thousandths of a second.

However, that’s “close to an eternity in automated trading,” according to professor Ben Van Vliet at the Illinois Institute of Technology.

Adding: “This is all about picking gold coins up off the floor – only the fastest person is going to get the coins.”

Can Charge What They Want

The company is currently holding the title as “The Low Latency King”.

That means they can charge eight to ten times the going rate, according to telecom analyst Donna Jaegers at D.A. Davidson & Co.

Allied Fiber charges $1.2 million for a 20-year Chicago-to-New York lease plus $235,000 a year for server space and maintenance.

The big algorithmic traders have to pay up, no matter the cost.

Chicago proprietary houses such as Getco, Wolverine and Citadel are undoubtedly amongst the customers of Spread Networks, according to Jon A. Najarian at OptionMonster.

He reckons that the New York banks with their own algorithmic trading desks, such as UBS, Goldman Sachs and Morgan Stanley are using the same Spread Networks, too.

The Greed For Speed

Two years ago, hotshot trader Daniel Spivey approached James Barksdale looking for money for a rather “quixotic” venture:

To dig, from scratch, a super fast fiber cable route for sending trades beteen Chicago and New York.

It would be nearly as straight as the crow flies and create a new critical link for speed-obsessed traders.

“At first I said, Come on, you’re pulling my leg,” he recalls, wondering how you would plunge through mountains at a reasonable cost.

But as he pondered it he realized, “If it wasn’t a tough problem, somebody else would have already done it.”

Daniel Spivey had earned his trading chops at the Chicago Board Options Exchange.

He became one of the exchange’s first remote market-makers in 2005 when he set up shop in his hometown of Jackson to trade options for the s&p 500 index.

In 2007 Spivey contracted with a New York hedge fund to devise a low-latency arbitrage strategy, wherein the fund would search out tiny discrepancies between futures contracts in Chicago and their underlying equities in New York.

Controls The Dark

Such popular arbitrage strategies demand screaming speed between Chicago and New York on what’s called “dark fiber,” the industry term for unused fiber-optic strands that can be sold or leased.

The entirety of the strand’s bandwidth belongs to the leaser, who supplies his own lasers, which can cost more than $5 million, to light the line and transmit information.

Spivey composed the program for the hedge fund, but he couldn’t execute it.

But he needed the market’s lowest latency path, on which no space was available.

Spivey spent ten months researching the feasibility of building a new and faster line before he approached Jim Barksdale.

Spivey and David Barksdale immediately set out on a series of road trips, meeting with county boards, state highway commissions and private landowners.

Barksdale helped finance the company and became chairman. Barksdale’s son, David, a mergers-and-acquisitions lawyer, became chief executive.

The result was Spread Networks of Ridgeland – the ultimate trading weapon.

Spread Networks says on their website:

“We trenched a new route-a direct route with microseconds in mind-to provide firms with the necessary infrastructure to;”

- Take control of New York to Chicago telecommunications.

- Operate enterprise networks free of typical telecommunications drag.

- Run at the fastest possible speed on the shortest possible route.

“The best way to maintain consistent low latency is to control your own network by operating on a private dark fiber system. Controlling a private network allows you to eliminate excess drag by choosing the most appropriate hardware solutions to fit your specific needs,” Spread says.

“Spread Networks offers financial firms a fresh supply of dark fiber on a completely new route-the shortest possible route from New York to Chicago.”

However, there is one web hoax that would have a path even faster than Spread’s:

A straight tunnel, through the earth, from Chicago to New York, avoiding the planet’s pesky curvature.

My guess is that someone is probably already working on it…

Related by The Swapper:

Testimony Of A High Frequency Trader

The Rise Of The New Market Makers

May 6. 2010: “The Black Thursday”

Wall Street Collapse: Did Somebody See It Coming?

U.S. Stock Crash Compels Further Investigation of Wall Street Scam

Big Banks Block OTC Clearing in “Proxy War”

Survey: Market Surprised By Negative Derivative Perception

Select Your Language:

Français * Italiano * Deutsch * Português * Español* Русский * العربية * Svenska* 中文 * 日本語

Related Articles

- TABB Says Long-Distance, Low-Latency Networking Increasingly Critical To Trading (eon.businesswire.com)

- Ciena Expands Ultra-Low Latency Portfolio for Electronic Trading (eon.businesswire.com)

- Lexent Metro Acquired by Lightower Fiber (datacenterknowledge.com)

- ACTIV Financial Selects Hibernia Atlantic’s Global Financial Network (GFN) for Low Latency (eon.businesswire.com)

- The Great Race for Low Latency (blogs.forbes.com)

- CoreSite Pitches D.C. as Low-Latency Hub (datacenterknowledge.com)

[…] Read the full post at The Swapper: […]

[…] from: The Ultimate Trading Weapon « The Swapper By admin | category: ILLINOIS Institute of Technology | tags: bsee, chicago, erp, fastest, […]

[…] the original post here: The Ultimate Trading Weapon « The Swapper By admin | category: chicago high internet speed | tags: fastest, gladden, gopher-hole, […]

[…] econotwist пишет: (September 1999 to present); Sun Microsystems, Inc. (April 1999 to January 2010); Mayo Clinic (February 2001 to present, served as chairman 2006 – 2010); In-Q-Tel (June 2003 to present); Dick Clark Productions, Inc. (April 2008 to present) … to an eternity in automated trading,” according to professor Ben Van Vliet at the Illinois Institute of Technology. Adding: “This is all about picking gold coins up off the floor – only the fastest person is going to get the coins.” … […]

[…] The Ultimate Trading Weapon […]

[…] The Ultimate Trading Weapon […]